The digital gold rush is ever-evolving, a landscape sculpted by volatile markets, technological leaps, and regulatory winds. At the heart of this pulsating ecosystem lies Bitcoin mining, a computational marathon demanding specialized equipment and a savvy understanding of economic tides. The question that weighs heavily on prospective and seasoned miners alike: Is now the time to invest? Can we, with any degree of accuracy, forecast Bitcoin mining equipment prices?

Predicting the future of any market, especially one as dynamic as cryptocurrency, is fraught with peril. However, by examining key factors influencing mining equipment prices, we can construct a more informed, albeit speculative, outlook. These factors include Bitcoin’s price trajectory, mining difficulty, advancements in ASIC technology, and global economic conditions.

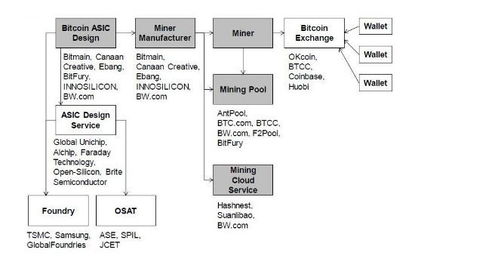

Bitcoin’s price, unsurprisingly, exerts a gravitational pull on mining equipment demand. A surging Bitcoin price typically triggers a buying frenzy, as miners scramble to capitalize on increased profitability. This surge in demand inevitably drives up the price of ASICs (Application-Specific Integrated Circuits), the specialized computers designed for Bitcoin mining. Conversely, a bear market can lead to a glut of mining equipment, pushing prices downward. It’s a delicate dance of supply and demand, amplified by the inherent volatility of the underlying asset. Ethereum, while moving away from Proof-of-Work, still influences the GPU market, impacting the broader landscape of computational hardware used in some altcoin mining endeavors.

Mining difficulty, a measure of the computational power required to solve a Bitcoin block, is another crucial determinant. As more miners join the network, difficulty automatically adjusts upwards to maintain a consistent block creation rate. This escalating difficulty necessitates more powerful and efficient mining equipment, rendering older models obsolete and driving demand for the latest generation ASICs. The arms race for hash power never ceases, pushing manufacturers to innovate and miners to upgrade.

Technological advancements in ASIC technology represent a continuous disruptive force. Each new generation of ASICs boasts improved energy efficiency and higher hash rates, translating to greater profitability for miners who adopt them. The advent of 5nm and even 3nm chips has dramatically altered the playing field, leaving older, less efficient hardware struggling to compete. However, these cutting-edge chips often come with a hefty price tag, creating a trade-off between upfront investment and long-term profitability.

Global economic conditions, including electricity prices, interest rates, and geopolitical stability, also play a significant role. High electricity costs can render mining unprofitable in certain regions, impacting demand for mining equipment. Rising interest rates can make it more expensive to finance mining operations, dampening investment. Geopolitical instability can disrupt supply chains and create uncertainty, further influencing market dynamics. Even the seemingly whimsical world of Dogecoin can, in its own way, impact hardware availability as miners diversify their pursuits.

So, is now the time to buy? The answer, predictably, is nuanced. If Bitcoin’s price continues its upward trajectory, and you can secure access to efficient, next-generation ASICs at a reasonable price, then the investment may be worthwhile. However, it’s crucial to conduct thorough due diligence, factoring in electricity costs, mining difficulty projections, and the potential for technological obsolescence. Mining farm considerations are also essential – location, cooling, security all contribute to the overall profitability equation.

For those seeking a less capital-intensive approach, mining machine hosting offers an alternative. Hosting services provide the infrastructure, including electricity and cooling, allowing miners to deploy their equipment without the burden of managing their own facilities. This option can be particularly attractive for smaller miners or those located in regions with high electricity costs. Exchange rates also matter when projecting profitability, adding another layer of complexity to the equation.

Ultimately, the decision to invest in Bitcoin mining equipment hinges on a careful assessment of risk and reward. There’s no crystal ball that can accurately predict the future, but by understanding the key factors influencing the market, miners can make more informed decisions and navigate the ever-shifting sands of the digital gold rush. Consider the long-term strategy, the potential for altcoin mining, and the overall health of the cryptocurrency ecosystem before diving in. The time might be now, but informed action is the key to success.

Leave a Reply