In recent years, the crypto mining landscape has experienced tides of change, influenced by technological advancements, regulatory frameworks, and market dynamics. As digital currencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) continue to gain traction, it’s imperative for investors and stakeholders to understand the global trends reshaping mining investment opportunities. The question isn’t just about what to mine, but also where and how to mine effectively.

One of the predominant trends affecting mining investment is the rise in decentralized finance (DeFi) applications. DeFi is reshaping how transactions occur, enabling individuals to lend, borrow, and trade assets without intermediaries. This trend necessitates robust mining infrastructure—further driving demand for high-performance mining rigs. Investors have started gravitating towards companies that not only manufacture mining machines but also offer hosting services, allowing them both to invest in hardware and access expert management.

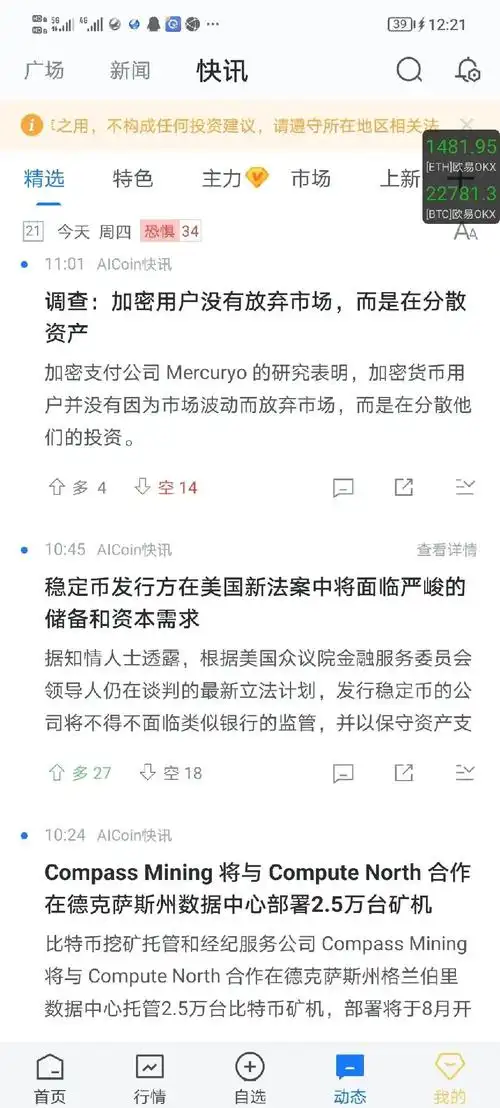

Moreover, geographical diversification is becoming a key strategy for mining operations. Regions with abundant renewable energy sources, such as Iceland and Norway, are attracting miners due to reduced operational costs. As countries like China have tightened regulations on crypto mining, it opens doors for investors to explore international territories rich in natural resources and supportive policies. This shift fuels interest in hosting services that can mitigate risks while maximizing profits through efficient energy use.

Another significant factor is the evolution in mining hardware technology. The continuous innovation in ASIC (Application-Specific Integrated Circuit) miners has enhanced efficiency and processing power, allowing miners to achieve higher hash rates at lower electricity costs. Investing in the latest mining rigs is not just a financial commitment; it’s a strategic decision that plays a critical role in how competitive one can be in the market. As the network changes its technology and algorithms, adaptive and efficient hardware becomes imperative.

Furthermore, the emergence of alternate cryptocurrencies like Dogecoin emphasizes the importance of versatility in mining strategies. While BTC remains the heavyweight champion of digital currencies, the demand for other altcoins is soaring. Diversifying mining portfolios is a viable strategy to hedge against market volatility. Consequently, companies providing tailored mining solutions, including hosting for various cryptocurrencies, are likely to thrive.

Investment in mining farms also necessitates awareness of regulatory environments. Governments worldwide are unveiling their stances on cryptocurrency mining—some encouraging it, while others impose stringent regulations. Understanding local and international laws is crucial for investors contemplating new mining ventures or hosting services. This regulatory sentiment can instantly affect the viability of crypto operations, ranging from tax incentives to environmental guidelines. Therefore, aligning with compliance-friendly miners is imperative for sustained growth.

Additionally, community engagement and collaboration within the crypto ecosystem are burgeoning. The way miners, investors, and developers interact is entering a more multifaceted and integrated phase. Participation in forums, seminars, and cooperative mining pools can create opportunities for sharing knowledge and resources, amplifying both gains and network security. Establishing a charismatic and knowledgeable presence within such communities can yield substantial insights and forecasts relevant for investment decisions.

As technology advances, ongoing discussions about sustainability take center stage. Conscious investors are considering not just the profits from their mining endeavors but also their environmental impacts. Companies with clear sustainability initiatives are positioning themselves favorably within the market. Hosting services that emphasize green energy usage attract a more environmentally aware investor base, providing diverse avenues for investment. The balance of profitability and sustainability is fast becoming a measurement of long-term success in the mining industry.

In conclusion, the cryptocurrency mining landscape is a tapestry woven from diverse threads—technological advancements, regulatory frameworks, alternative investments, community engagement, and sustainability. Investors who stay attuned to these trends while embarking on their mining ventures are more likely to secure resilient and fruitful paths in the ever-evolving crypto space. By carefully evaluating these dimensions, one can not only ride the current wave of crypto innovations but also actively shape its future.

Leave a Reply